Why Long-Term Investing Matters for Entrepreneurs

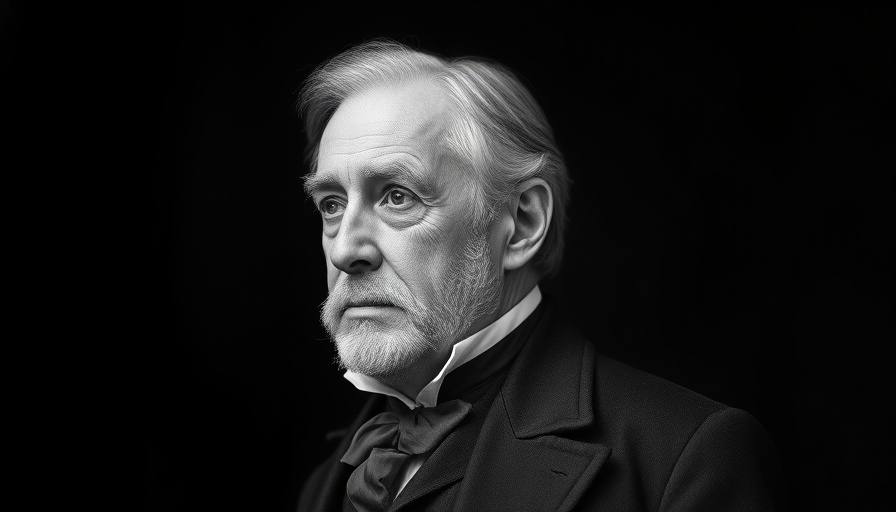

In an unpredictable economic landscape, entrepreneurs and side hustlers often seek sustainable pathways to financial security. Charles D. Ellis’s book, Rethinking Investing: A Very Short Guide to Very Long-Term Investing, is an invaluable resource that encourages a paradigm shift in how we perceive investment strategies. His advocacy for frugality and the power of long-term savings resonates deeply with those striving for entrepreneurial success.

Understanding the Impact of Compounding

Ellis emphasizes the significant role that compounding plays in growing one’s savings. For entrepreneurs, saving wisely is akin to investing in the longevity of their business. By understanding that even minor adjustments in their saving habits can lead to substantial long-term gains, individuals can unlock the full potential of their financial endeavors.

Challenges to Conventional Wisdom

The author challenges the traditional wisdom surrounding investment, such as the common practice of allocating bonds according to one’s age. In these uncertain times, Ellis urges readers to consider their financial comfort and individual circumstances rather than adhering strictly to formulas that may not apply universally. Entrepreneurs, in particular, can benefit from this tailored approach to investing, aligning their strategies with their personal and business goals.

Seeking Professional Guidance

While Ellis is critical of hiring financial planners on a continuous basis, he acknowledges that seeking professional help may be prudent for those who struggle to manage their investments independently. Building a relationship with a Registered Investment Advisor can provide tailored insights without the burden of perpetual fees, making investment management more approachable for entrepreneurs and small business owners.

Personal Narrative: A Growth Journey

This book doesn't just present numbers; it invites readers into a story of growth and understanding. For many entrepreneurs, the path to financial security is flanked with emotional and psychological hurdles. Ellis's candid discussion about common pitfalls—like panic selling during market declines—humanizes the often dry world of investing.

In conclusion, Ellis's guide offers more than just formulas; it cultivates an attitude of practicality regarding financial decision-making. By embracing long-term strategies, entrepreneurs can ensure their investment choices bolster not just their personal financial health but also the sustainability of their ventures. This guide is a must-read for anyone looking to navigate the intricate world of investments, ultimately paving the way toward financial freedom and prosperity.

Add Row

Add Row  Add

Add

Write A Comment