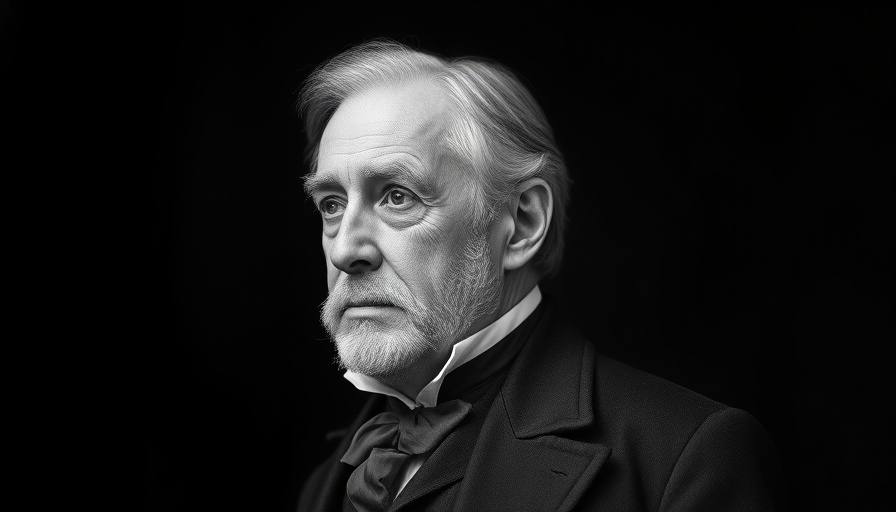

The Leadership Lessons of Lincoln: Patience and Discipline

Abraham Lincoln's approach to leadership and decision-making provides timeless lessons for passive investors. The sixteenth President of the United States demonstrated immense patience, delaying critical actions until the time was right. This is akin to passive investing, where understanding that building wealth requires time—and not hasty moves—is crucial. Lincoln said, “We shall sooner have the fowl by hatching the egg than by smashing it,” and this philosophy aligns with the idea that placing trust in a diversified portfolio over time yields more favorable results than trying to time the market.

Investing with Character: The Lincoln Model

Lincoln’s character, underscored by integrity and commitment to long-term goals, can serve as a model for today's investors. His saying, “Give me six hours to chop down a tree and I will spend the first four sharpening the axe,” emphasizes the importance of preparation. Just as Lincoln meticulously planned his speeches and policies, investors should approach their financial strategies with diligence and clarity. Passive investment strategies thrive on understanding risk tolerance, diversification, and long-term potential rather than succumbing to the whims of market fluctuations.

How Lincoln’s Vision Guides Modern Investors

Embracing Lincoln's strategic vision involves not getting distracted by market fads but focusing on a thoughtful, disciplined investment approach. His legacy highlights how adopting patience and discipline can empower passive investors to cultivate enduring financial success. Entrepreneurs, small business owners, freelancers, and side hustlers can build a financially sound future by integrating Lincoln's principles into their investment strategies.

As you consider your financial journey, think about how you can apply the timeless wisdom of a leader like Lincoln. Are you investing with the same strategic patience he exemplified? By aligning your investment philosophy with core values such as integrity and balanced decision-making, you'll be better equipped to navigate the complexities of today's market while ensuring long-term financial growth.

Add Row

Add Row  Add

Add

Write A Comment